Growth

- While the global economy has been surprisingly resilient in H1 2025 given the US tariff shock, it remains on a fragile footing and susceptible to downside shocks

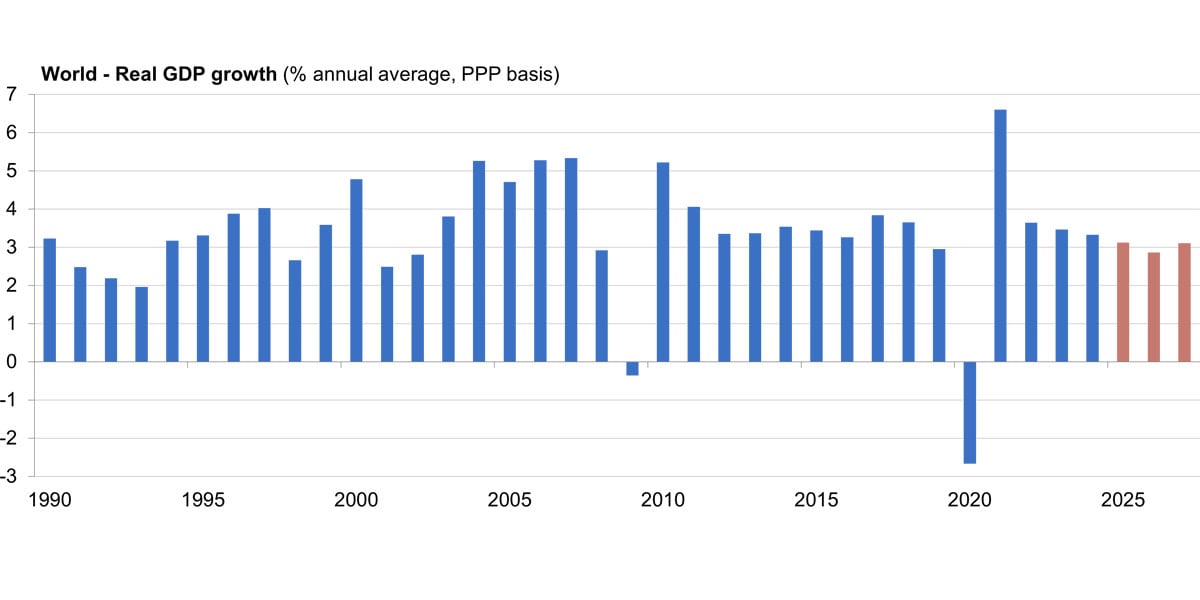

- Nonetheless, our base case view remains for the global economy to continue to muddle through. Global real GDP growth is forecast to slow from a 3.3% pace in 2024 to close to a 3% pace over coming years, around ½ ppt below the pace seen in the decade prior to COVID.

- The US economy is forecast to slow to a below-trend pace in Q4 2025 given the fallout from the tariffs and government shutdown, with a recovery building in 2026 due to more expansionary fiscal policy from the One Big Beautiful Bill.

- China’s economy held-up well over H1 2025 due to increased policy stimulus from Chinese authorities. However, momentum has started to cool due to China’s anti-involution policy and growth is expected to slow in H2 2025 and 2026.

;

;