QIC is leading a new investor gateway to connect investors and developers with opportunities on priority energy projects in partnership with Queensland energy GOCs.

21

19 year

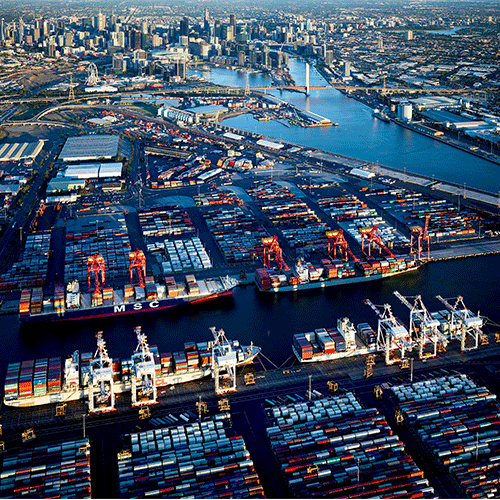

Delivering attractive risk-adjusted returns for our clients through a thematic, sector-centric international infrastructure investment strategy.

Since 2006, we have constructed diversified portfolios that produce attractive investment outcomes across market cycles – managing A$41.4billion (US$27.2billion)* across 21 direct infrastructure investments in five OECD countries. We have successfully realised five investments, delivering strong performance to our investors.

The global unlisted infrastructure market continues to provide compelling investment opportunities and diversification for investors who adopt an active long-term thematic approach across geography, sector and lifecycle.

Learn more about our investment process and track record.

Thematic sector-centric focus

Through a thematic top-down, bottom-up lens, we identify key megatrends that present narrow opportunities to meet the needs of our clients. In this way we can take account of long-term risks and disruptors and find relative value across sectors and the value chains embedded in them.

Given the diversity of infrastructure assets, we believe this is the most effective way to identify relative value, understand operating environments, and build resilient portfolios not purely sculpted by geography, size of investment or sector.

Our OECD focus is characterised by:

- A core sector focus across energy & utilities, transport, and social & healthcare

- Deep expertise in these sectors leveraging detailed industry knowledge and relationships across multiple regions and regulatory environments

- Our 86-person investment team with offices on the ground in Australia, the UK, and the US

- Our extensive and highly qualified global network of 55 non-executive directors and advisors.

Thought leadership

- Listen to our podcasts and read our thought leadership to learn more about our latest infrastructure insights, emerging infrastructure opportunities and the energy transition

Meet the Infrastructure team

Each member of the QIC team brings a unique combination of specialist skills, experience and perspectives to the table. We value credentials but conviction is what counts.

* Gross AUM as at 30 September 2025. Calculated using (i) the latest available total market value of assets managed by QIC entities; (ii) undrawn commitments.

;

;