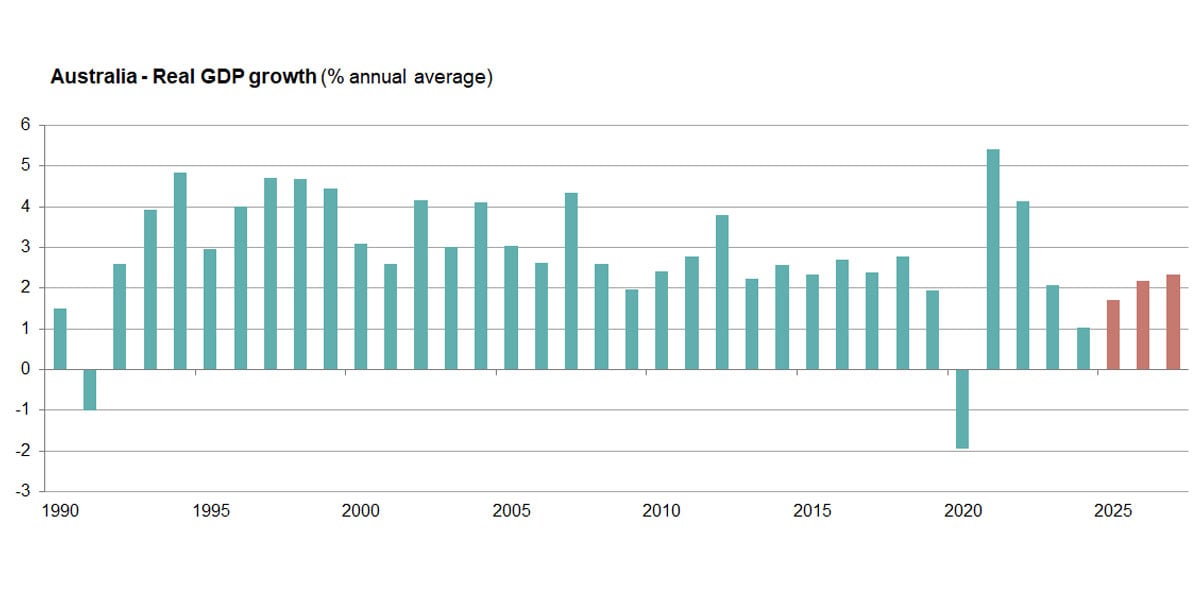

Growth

- The Australian economy is not immune to global developments but is well-positioned to outperform most of its developed economy peers.

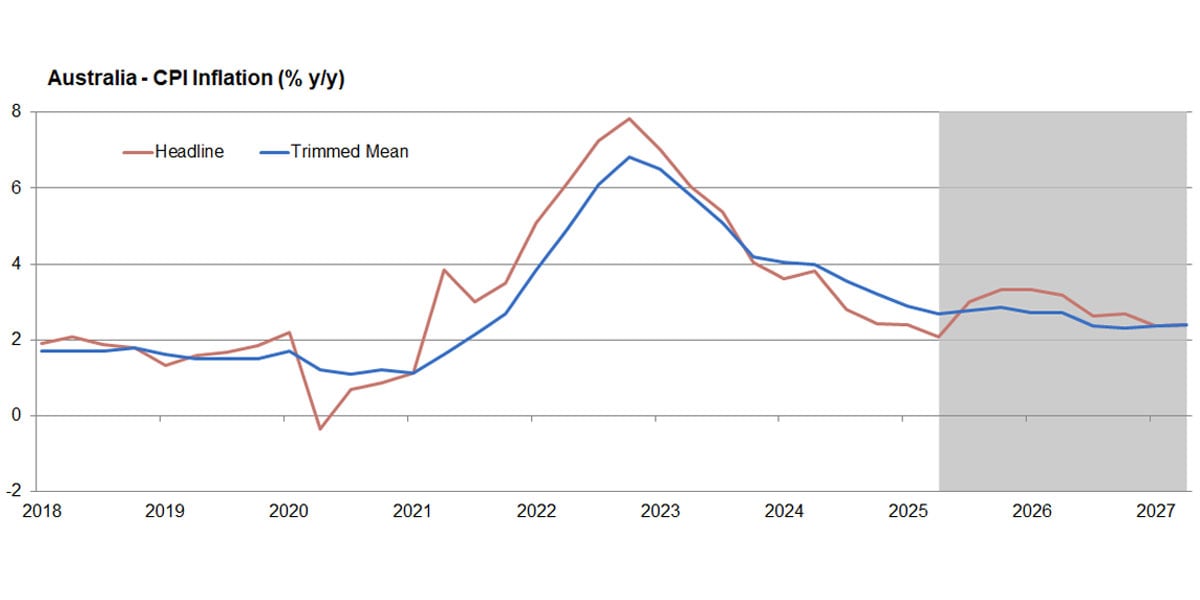

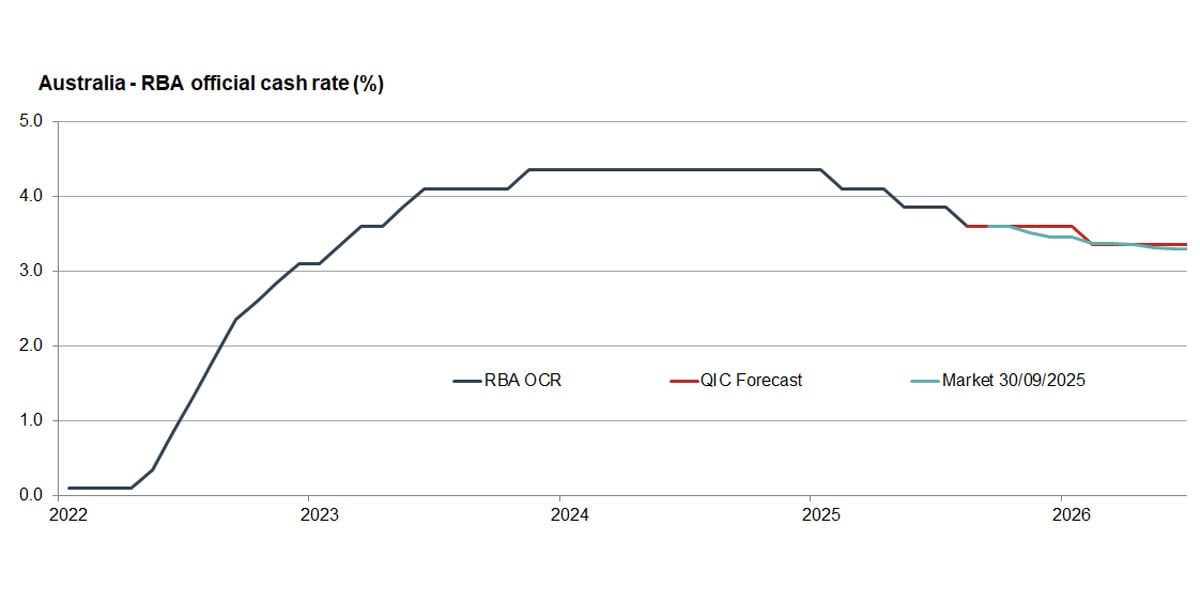

- The economy has gained momentum over the last year with tax cuts, monetary policy easing and lower inflation supporting real incomes and spending. However, consumers remain price-sensitive and cautious, increasing savings and keeping a lid on the pace of recovery this year.

- Headwinds from the global economy will weigh on the Australian economy this year, keeping business investment and exports subdued. As trade tensions stabilise into 2026, economic growth will accelerate toward trend.

;

;