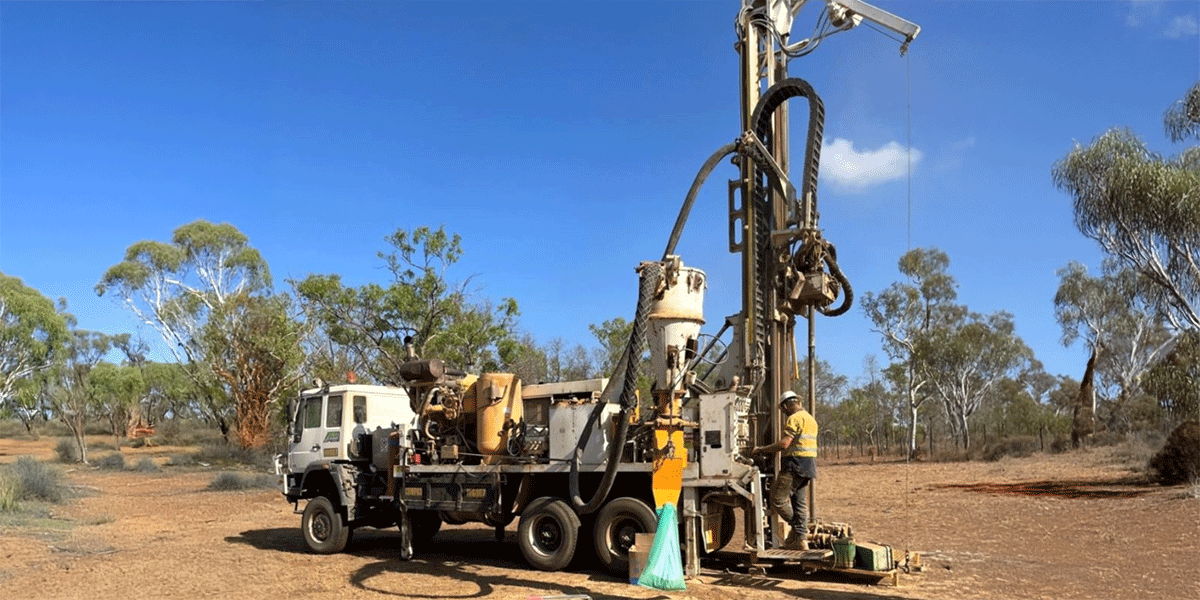

Source: Ark Mines

Source: Ark MinesThe QIC Critical Minerals and Battery Technology Fund (QCMBTF) is unlocking Far North Queensland's minerals potential with $4.5 million to support Ark Mines' flagship Sandy Mitchell Rare Earths Project.

Located 230 kilometres northwest of Cairns, the project contains a significant resource of rare earth elements (REEs) hosted in mineral sands, including high-demand magnet metals such as neodymium, praseodymium, terbium, and dysprosium.

These elements are critical inputs for electric vehicles, wind turbines, robotics, and other advanced manufacturing technologies.

The QCMBTF funding package enables Ark Mines to progress Sandy Mitchell through to a Final Investment Decision (FID) and undertake further drilling to expand the current resource base.

QIC Senior Investment Director Jonathan Crombie said Sandy Mitchell has the potential to be a strategically significant, long-life asset producing essential rare earth elements outside of Asia.

"As the world accelerates its transition to net zero, the need for secure and sustainable sources of rare earths has become a strategic priority for governments and industries globally,"Jonathan Crombie - QIC Senior Investment Director

“Recent export restrictions have not only raised geopolitical concerns, but international markets are actively seeking alternative, reliable sources of REE supply.

“Projects like Sandy Mitchell represent a strategic opportunity for Australia, and particularly Queensland, to help rebalance global supply chains and secure long-term economic, environmental, and geopolitical advantages.

“With high-grade mineralisation and a focus on producing concentrate at scale, Ark Mines can place Queensland at the forefront of this supply chain shift.”

Ark Mines Executive Director Ben Emery said the project is estimated to have a short construction time owing to the surface level deposit.

“This means Sandy Mitchell can be quickly developed and start production with simple mining and low environmental impacts,” Mr Emery said.

“Most of the processing has already been done by mother nature, so to produce a monazite concentrate, simple low-cost gravity separation is all that is required, reducing our environmental footprint.

“QIC’s investment provides the Sandy Mitchell project certainty as we transition into mine planning and continue discussions with offtake partners domestically and internationally.”

More than 80 local jobs could be supported once the mine is in full production.

The $150 million QIC Critical Minerals and Battery Technology Fund is a Queensland Government initiative managed by QIC, with earlier capital investments including Alpha HPA’s synthetic sapphire project in Gladstone.

QCMBTF’s advisers on the transaction are BurnVoir Corporate Finance and Allens.

For more information about, visit Queensland Critical Minerals and Battery Technology Fund

QIC is a trusted Australian investment manager and sovereign investor, delivering with discipline across a global portfolio of alternative and liquid assets. We manage more than A$131 billion on behalf of around 120 institutional and government clients, providing specialist expertise across infrastructure, real estate, private equity, private debt, and fixed income and multi-asset solutions.