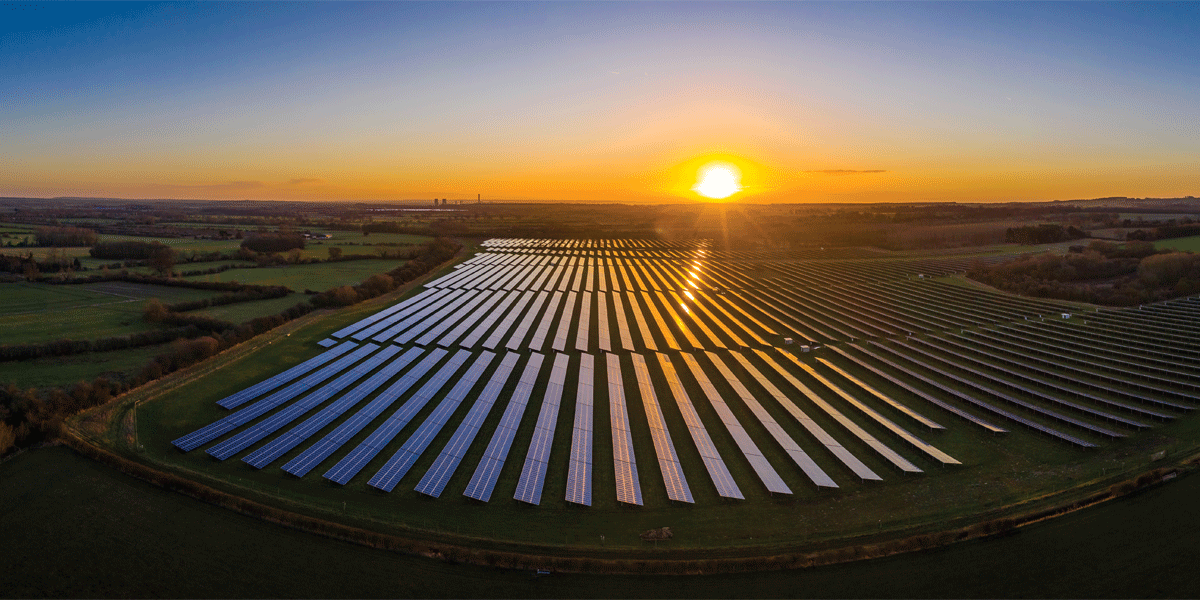

Image source: Renewa

Image source: Renewa100%

Energy & Utilities

United States

As the global energy transition accelerates, securing the land needed for the growing scale of renewable energy infrastructure and projects is becoming more critical than ever. In the US, it is estimated that more than 20 million acres of land will be needed to house the solar, wind and energy storage facilities required to achieve the country’s net zero commitments.1

In line with QIC Infrastructure’s thematic-based investment strategy, which focuses on the decarbonisation megatrend (alongside deglobalisation, decentralisation and an ageing population), the QIC Infrastructure team is investing in securing land capacity for US renewable energy projects through its portfolio company, Renewa.

Investment background

In 2022, QIC (on behalf of a managed client) acquired Renewa, a rapidly growing ‘land-under-infrastructure’ platform that provides long-term capital solutions to landowners and renewable energy project developers across the US. Since QIC’s acquisition, Renewa’s portfolio has grown from 16 operators across 4 states to more than 60 operators across 26 states.

Providing specialised financial solutions to landowners and renewable energy operators, Renewa either owns the land or holds a ground lease on the land under more than 150 renewable energy facilities across the US, with a presence in renewables projects accounting for more than 35 gigawatts of renewable energy.

What is a ground lease?

Ground leases generate long-term, fixed, recurring and predictable cashflows, and in most cases, the lessee is a special purpose vehicle owned by a high-quality, investment-grade counterparty.

Ground lease repayments are typically at the top of the waterfall payment in any given renewable energy project, typically paid prior to senior debt. Ground leases therefore offer long-term, contracted cashflows that are insulated from operating, production and pricing risk.

Renewa has one of the most diversified land exposures to renewable energy projects in the US. Renewa estimates that projects on its ground lease assets reduced carbon dioxide emissions in the US by approximately 5 million tonnes in 2023.2

Active management approach

By 2023, Renewa had secured US$450 million of equity and debt commitments, in alignment with QIC’s strategic focus on the energy transition. QIC’s capital raising efforts have secured additional investment into the business, supporting Renewa’s continued success as it further expands its presence in the US.

Other initiatives QIC has partnered with Renewa to deliver over the two years since acquisition include:

- Working alongside the Renewa team to implement corporate governance best practice initiatives, including enhancements to corporate reporting and underwriting

- Engaging in industry network outreach, leveraging our relationships across the renewables sector to market Renewa

- Developing innovative partnership structures, enabling developers to secure site access for development-stage renewables projects

- Leading the sourcing, evaluation and structuring of a number of bolt-on opportunities across land associated with adjacencies including transmission storage, hydrogen, low carbon mobility and carbon reduction.

Through our active management relationship, we look forward to continuing to support Renewa’s growth across the US.

Citations

- Roland Berger, 2024. Renewables land financing market report.

- Renewa, 2023.

Further information

This article is subject to the QIC Disclaimer and website access terms and conditions.