The narrative in markets over the last year has been simple: will the US achieve the mythical ‘soft landing’ or will higher rates push the US economy into recession? A ‘soft landing’ is now the consensus view and is fully priced into markets. Is this truly the end of the debate?

We think not.

Our view is that markets are entering a new stage, where risks are more symmetric rather than skewed to the downside, with the changing skew being driven by conflicting signals from US data. We see signs of an emerging upside risk, that of a ‘second wind’ to economic growth, spurred by recent strong non-farm payrolls and GDP reports. But at the same time, softening hiring intentions data and subdued business surveys still suggest that a recession cannot be ruled out. These scenarios have very different implications and a nimble approach will be key to navigating markets over the coming months.

The narrative in markets has shifted away from ‘recession risk’ but our view is that investors risk becoming complacent. A soft landing may now be the most likely scenario, but recession risks are still very elevated. Historically, during most cycles, the economy often appears to be headed for a 'soft landing' just before going into recession.

One critical signpost of a recession – a significant rise in the unemployment rate – remains absent. However, it is not unusual for the unemployment rate to take some time to show a definitive rise at the beginning of a recession.

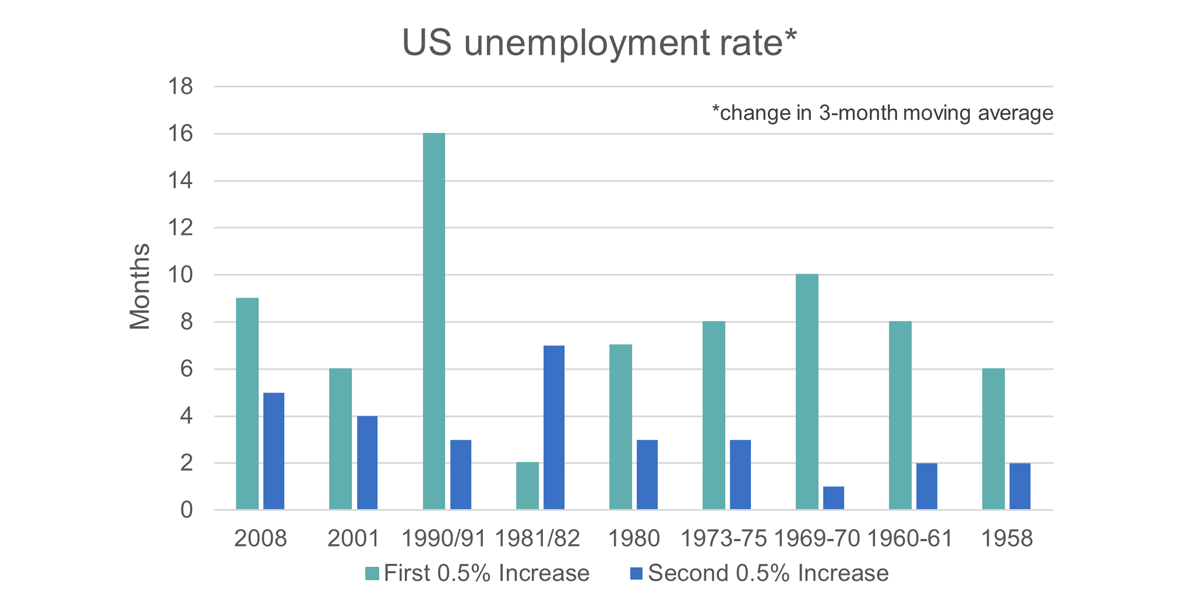

Our analysis shows that in US recessions, the first 0.5 percentage point (ppt) rise from the low in the unemployment rate can take an extended period (on average eight months), while the rise beyond that occurs much faster (on average three months for the next 0.5ppt).

Source: QIC & Bloomberg, 13 February 2024

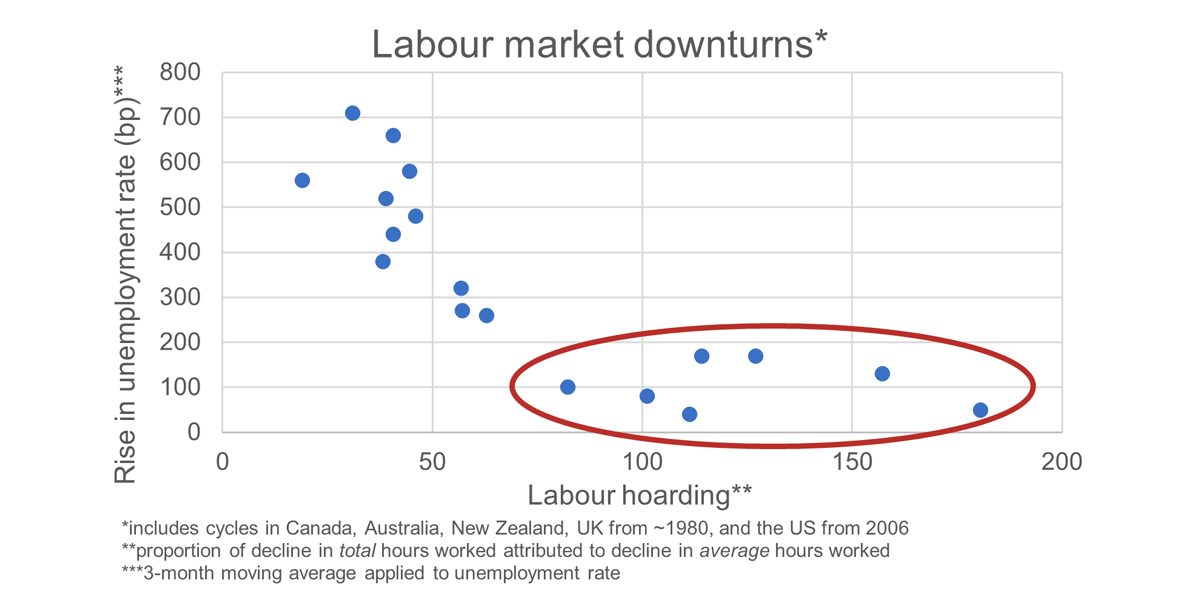

Source: QIC & Bloomberg, 13 February 2024The reason is that businesses initially tend to respond to softer conditions via reducing hiring and reducing hours worked. In other words, they hoard labour. It is only as economic weakness persists that employers cut jobs.

Our analysis shows this pattern is consistent across a number of developed economies. When the unemployment rate rises a mild-to-moderate amount, most of the adjustment in the labour market is via a reduction in average hours worked, rather than employment. It is only during severe downturns in the labour market that broad-based job losses occur.

Source: QIC & Bloomberg, 13 February 2024

Source: QIC & Bloomberg, 13 February 2024We are tracking the labour markets of a number of developed market economies, including Australia, versus historical cycles and the majority are still within the normal bounds of typical pre-recession behaviour. We note, in particular, that the Australian labour market has softened at an accelerating pace since Q4 2023 in line with the softening in business conditions. Thus, we cannot rule out recession risks in the US and Australia and we remain cautious about valuations in credit markets in such a scenario.

Nevertheless, it is also true that the US economy has been more resilient than most expected in the face of the fastest tightening in monetary policy in decades. It’s possible that a decade of abnormal rate settings made us all under-estimate the true neutral rate of interest, and we are simply now back to normal levels, not restrictive levels as is commonly thought. It may also be that the easing in broad financial conditions since November (as markets increased expectations of rate cuts by the Federal Reserve) has helped to reduce the immediate prospects of a deep downturn.

Regardless of the reason, the upside surprises in US GDP data recently means we have begun to factor a ‘second wind’ scenario into our estimates. In this scenario, growth is above trend and the labour market treads water, meaning that the deceleration in inflation begins to stall. Not only would that delay much anticipated rate cuts, but it could even put further rate hikes back into play. To be clear, we see this as a tail-risk, not our central scenario. But it is an important scenario to consider as markets are not currently priced for it, and it would likely be highly disruptive.

Investors need to be aware that the US economy is at a crossroad and risks to the outlook are increasingly two-sided. While market participants have been pleasantly surprised by 2023, we’re not so sure that markets will have a smooth 2024. We expect volatility to rise again in 2024. That volatility will likely present great opportunities, but right now we are choosing to keep some of our powder dry.

Further information

QIC Limited ACN 130 539 123 (“QIC”) is a wholesale funds manager and its products and services are not directly available to, and this document may not be provided to any, retail clients. QIC is a company government owned corporation constituted under the Queensland Investment Corporation Act 1991 (QLD). QIC is also regulated by State Government legislation pertaining to government owned corporations in addition to the Corporations Act 2001 (Cth) (“Corporations Act”). QIC does not hold an Australian financial services (“AFS”) licence and certain provisions (including the financial product disclosure provisions) of the Corporations Act do not apply to QIC. Other wholly owned subsidiaries of QIC do hold AFS licences and are required to comply with relevant provisions of the Corporations Act. QIC also has wholly owned subsidiaries authorised, registered or licensed by the United Kingdom Financial Conduct Authority (“FCA”), the United States Securities and Exchange Commission (“SEC”) and the Korean Financial Services Commission. For more information about QIC, our approach, clients and regulatory framework, please refer to our website www.qic.com or contact us directly.

To the extent permitted by law, QIC, its subsidiaries, associated entities, their directors, officers, employees and representatives (“QIC Parties”) give no warranty of any nature whatsoever in relation to the information contained in this document (“Information”) and disclaim all responsibility and liability for any loss or damage of any nature whatsoever (including without limitation any consequential loss) which may be suffered by any person directly or indirectly through the provision to, or use by any person of the Information, including whether that loss or damage is caused by any fault or negligence or other conduct of the QIC Parties or otherwise. Accordingly, you should not rely on the Information in making decisions in relation to your current or potential investments. This Information is general information only and does not constitute financial product advice. You should seek your own independent advice and make your own independent investigations and assessment, in relation to it. In preparing this Information, no QIC Party has taken into account any investor’s objectives, financial situations or needs and it may not contain all the information that a person considering the Information may require in evaluating it. It should not be relied upon by investors. Investors should be aware that an investment in any financial product involves a degree of risk and no QIC Party, nor the State of Queensland guarantees the performance of any QIC fund or managed account, the repayment of capital or any particular amount of return. No investment with QIC is a deposit with or other liability of any QIC Party. The Information may be based on information and research published by others. No QIC Party has confirmed, and QIC does not warrant, the accuracy or completeness of such statements. Where the Information relates to a fund or services that have not yet been launched, all Information is preliminary information only and is subject to completion and/or amendment in any manner, which may be material and without notice. It should not be relied upon by potential investors. The Information may include simulations, examples or opinions, or statements and estimates in relation to future matters, many of which will be based on subjective judgements, assumptions as to future events or circumstances, or proprietary internal modelling. No representation is made that such statements or estimates will prove correct. The reader should be aware that such Information is predictive in character and may be affected by inaccurate assumptions and/or by known or unknown risks and uncertainties and should independently investigate, consider and satisfy themselves in relation to such matters. Forecast results may differ materially from results or returns ultimately achieved.

Past performance is not a reliable indicator of future performance.

The Information is being given solely for general information purposes. It does not constitute, and should not be construed as, an offer to sell, or solicitation of an offer to buy, securities or any other investment, investment management or advisory services, including in any jurisdiction where such offer or solicitation would be illegal. This Information does not constitute an information memorandum, prospectus, offer document or similar document in respect of securities or any other investment proposal. The Information is private and confidential. It has not been and is not intended to be deposited, lodged or registered with, or reviewed or authorised by any regulatory authority in, and no action has been or will be taken that would allow an offering of securities in, any jurisdiction. Neither the Information nor any presentation in connection with it will form the basis of any contract or any obligation of any kind whatsoever. No such contract or obligation in connection with any investment will be formed until all relevant parties execute a written contract and that contract will be limited to its express terms. QIC does not make any representation with respect to the eligibility of any recipients of the Information to acquire securities or any other investment under the laws of any jurisdiction. Neither the Information nor any advertisement or other offering material is or may be distributed or published in any jurisdiction, except under circumstances that will result in compliance with any applicable laws and regulations.

Investors or prospective investors should consult their own independent legal adviser and financial, accounting, regulatory and tax advisors regarding this Information and any decision to proceed with any investment in connection with the Information.

Your receipt and consideration of the Information constitutes your agreement to these terms.

This document contains Information that is proprietary to the QIC Parties. Do not copy, disseminate or use, except in accordance with the prior written consent of QIC.