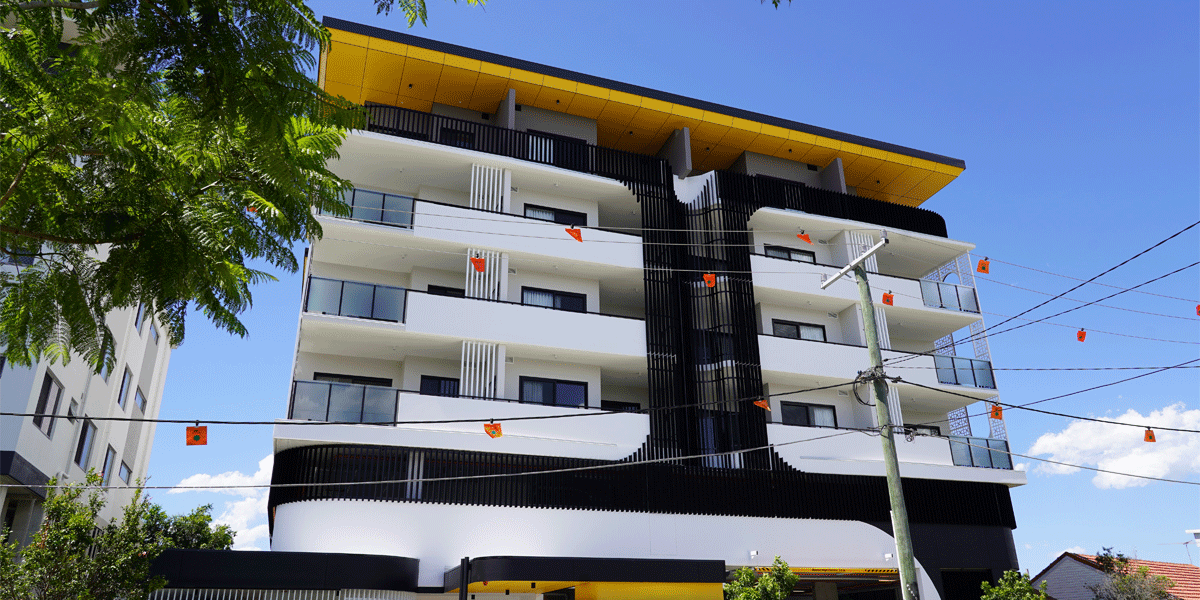

Image: Social and affordable housing development in Brisbane's northside

Image: Social and affordable housing development in Brisbane's northsideThree years on, the Queensland Social Housing Fund (QSHF) is delivering on its ambition to increase the supply of social and affordable housing across the state.

QSHF was established by QIC in partnership with Australian Retirement Trust (ART) to create a pathway for institutional capital to support the delivery of long-term social and affordable housing. Its launch followed QIC and Brisbane Housing Company (BHC) securing financial support from the Queensland Government to progress new housing projects.

Through a scalable financing model, QIC aligned investor objectives, community needs and government priorities – demonstrating how private capital can be mobilised to deliver public good, returning an investment return commensurate with the risk.

Today, development of the housing is well underway, with seven projects representing ~600 dwellings, either complete or in various stages of construction, providing safe, secure housing for Queenslanders who need it most.

The challenge

Queensland, like many other regions, is grappling with a critical shortage of housing. Demand has outpaced supply – leaving many vulnerable residents without access to safe, secure homes.

While institutional capital has the potential to boost social and affordable housing supply at scale, traditional models for this housing often fail to attract such investment. For social and affordable rental housing, expenses make up a significant portion of gross rents, leaving thin margins. At the same time, traditional government funding programs, do not necessarily enable the scale needed to unlock long-term institutional interest. In short, the economics of social and affordable housing were often deemed prohibitive for any long-term institutional opportunity.

The challenge was clear: how could QIC - with the support of the Queensland Government - create a financing model that would deliver social and affordable housing at scale, while remaining attractive to institutional capital?

The approach

QIC responded with a collaborative solution –participating in a structured financing scheme – the first of its kind in Queensland. The approach allowed for lower-cost debt, supported by government subsidies, enabling a greater number of dwellings to be delivered per dollar invested.

The QSHF was seeded with A$150 million commitment from ART, structured as subordinated loans. Housing Australia committed $300 million— including $20 million from the NHIF Social and Affordable Housing program ($16 million senior loans and $4 million grant) and up to $280 million in senior loans from the Affordable Housing Bond Aggregator (AHBA). QSHF will also receive an ongoing subsidy support from the Queensland Government. By allowing the housing to be largely debt-funded, government subsidies optimised capital for the provision and operation of homes.

This was a sophisticated exercise in risk and return allocation – designed to meet the needs of all stakeholders.

QIC’s consortium with BHC was also central to the model’s success. With over 20 years’ experience delivering and managing social and affordable housing in Queensland, BHC brought the expertise and agility to deliver and manage the housing platform now and as it scales.

The outcome

The QSHF is now delivering tangible results. BHC is in the process of delivering ~600 dwellings. These homes are purpose built for social and affordable housing – providing long-term housing security for many Queenslanders for years to come.

This initiative sets a precedent in institutional investment in social housing. It demonstrates that with the right structure and partnerships in place, private capital can play a meaningful role in solving complex social challenges and create impactful investment opportunities.

QIC is proud to have co-created this innovative residential model, and grateful to its partners for their commitment. Together we are not only delivering homes, but we are also building equity for community housing providers, supporting government policy objectives and demonstrating how institutional investors can be part of innovative, long-term solutions to Australia’s housing challenges.