Key takeaways

- Australia’s compulsory superannuation industry, praised as the ‘envy of the developed world’, has transformed savings and investment patterns, significantly reducing the financial burden on the government as the population ages.

- The superannuation market is mature, managing the fourth largest pension pool globally, and expected to take second place by 2035.

- The superannuation industry has strengthened and stabilised the Australian investment landscape, fostering a sophisticated financial sector with deep expertise, opportunities and talent.

- With significant capital pools, superannuation funds are looking to international markets, opening up bigger opportunities for foreign capital to invest in Australia.

- Australia’s stable government and generally centrist politics, robust legal system, and a triple-A credit rating that reflects sound fiscal management, means that the country is a safe haven for offshore capital seeking consistent, secure returns.

Lauded by politicians and industry leaders as 'the envy of the developed world', Australia's compulsory superannuation industry has quietly become one of the world's largest institutional investors.1

Originally introduced as a voluntary policy benefit for high-income earners in the 1980s, superannuation has evolved into a compulsory savings system that covers nearly all working Australians and, theoretically, provides them with a financially comfortable retirement. Often referred to as ‘super’, money for the scheme is deducted from residents’ salaries and invested into private superannuation or pension funds that manage these long-term investments to grow over time.

With A$4.2 trillion in assets under management as of December 2024, Australia now has the fourth largest pension pool globally and is tipped to overtake Canada and the UK to become the world’s second largest behind the US by 2035. No small feat for a country with a population smaller than the US state of Texas.2

Figure 1: Top 10 pension markets by asset size in USD, 2023

Source: OECD Pension Markets in Focus 2024 (3)

Source: OECD Pension Markets in Focus 2024 (3)

The compulsory nature of Australia’s superannuation industry means that contributions are significant, with A$3.2 billion flowing into superannuation funds each week4. This scale benefits the nation’s economy now and over the long-term, reducing the government’s need to pay for age pensions. In fact, the cost of Australia's retirement system will remain more affordable than almost every other OECD country5.

Aside from benefiting Australians in their retirement, the superannuation industry has also created a legacy in the form of an experienced, sophisticated and well-regulated financial industry. When combined with the nation’s stable government and generally centrist politics, robust legal system, and a triple-A credit rating that reflects sound fiscal management, Australia is an increasingly attractive destination for offshore capital seeking consistent, secure returns. These characteristics are becoming increasingly important as global investors seek out stable opportunities during a time of financial market turbulence and geopolitical uncertainty.

When combined with the nation’s stable government and generally centrist politics, robust legal system, and a triple-A credit rating that reflects sound fiscal management, Australia is an increasingly attractive destination for offshore capital seeking consistent, secure returns.

The market comes of age

Australia’s Superannuation Guarantee (SG) requires employers to contribute a portion of employees’ wages into retirement accounts at least four times a year. With a growing pool of capital, Australian funds are increasingly looking to international opportunities to complement their domestic exposure6. AustralianSuper, Australia’s largest superannuation fund, deploys some 70% of its capital offshore7. The evolution further highlights the deepening finance sector sophistication the superannuation industry has fuelled.

The maturation of the market led to the market regulator, the Australian Prudential Regulation Authority (APRA), introducing a range of new regulations in 2021 under the banner of Your Future, Your Super (YFYS).

YFYS includes an annual performance test to improve the accountability, transparency and efficiency of the sector. The “performance benchmarking test” was designed to improve the industry’s efficiency, but it has also contributed to wholesale industry consolidation, reshaping the superannuation landscape in the process. As underperforming funds have been forced to merge or exit the market entirely, eight mega funds now manage more than A$100 billion in superannuation assets each, and together account for over half of all Australian superannuation assets.

Figure 2: Market share of the "Big Eight" superannuation funds

Source: Morningstar (8); Source: APRA (Annual Fund-level Superannuation Statistics, June 2024)

Source: Morningstar (8); Source: APRA (Annual Fund-level Superannuation Statistics, June 2024)

This robust oversight, together with the fact that these funds typically deploy capital in a counter-cyclical manner, is only strengthening domestic market opportunities9.

Necessity is the mother of invention

The growth of Australia’s superannuation industry has only strengthened the Australian the financial sector, and in turn, generated an equally strong pool of investment expertise and talent.

An example of this includes Australia’s 40 years of private infrastructure experience and track record in developing more efficient ways of managing infrastructure financing and development. Superannuation’s long-term horizon has also fostered a growing secondary market for infrastructure assets, which enables funds to recycle capital into new projects while also attracting fresh capital from offshore investment. This cycle of investment, reinvestment, and foreign capital inflow reinforces the country’s economic attractiveness on a global scale.

International institutional investors have shown increased interest in the Australian market in response, with major sovereign wealth and pension funds from Canada, Europe and Asia entering Australia via investments in infrastructure, renewable energy, agriculture, corporates and real estate. The Australian government's push for public-private partnerships (PPPs) in critical sectors such as the energy transition, transport, and digital infrastructure has further positioned the nation as a preferred global capital destination.

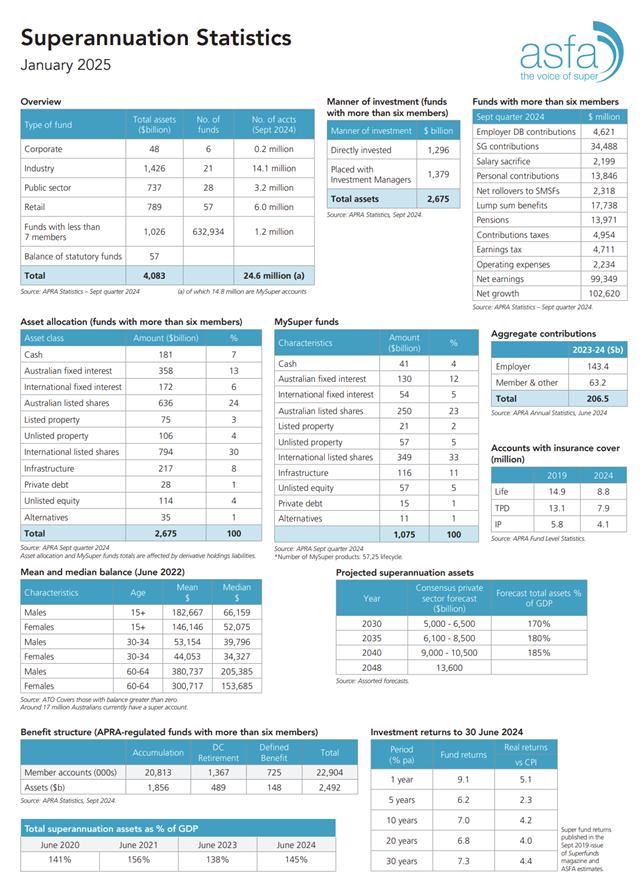

Figure 3: International Investment Position, by year (2002-2023)

Source: Australian Bureau of Statistics, International Investment Position, May 2024

Source: Australian Bureau of Statistics, International Investment Position, May 2024

Capital goes where it is welcome

The dual role of the superannuation industry as a developer of Australian financial market strength and a major global investor is set to strengthen. As offshore investors increasingly seek ou t the stability and sophistication of financial markets that superannuation has delivered, Australia’s government is overhauling its foreign investment framework and regulations to strengthen and streamline its approach to foreign investment.10

This will grow market efficiencies and create further opportunities for offshore capital flows into Australia, whether in its world-leading clean energy market, its expanding infrastructure, real estate, private debt and fixed income opportunities, or its expanding critical minerals and technology sectors.

And while the world’s financial markets remain turbulent, Australia, with its deep financial expertise and strong investment landscape, is a safe haven for foreign capital.

Appendix

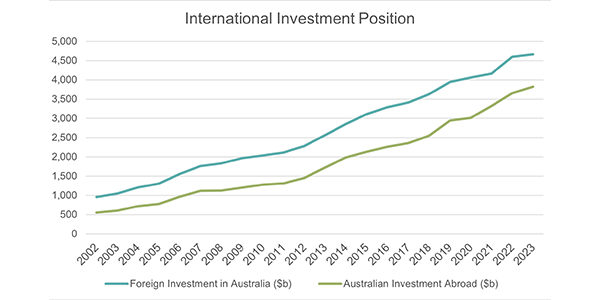

Australian superannuation statistics, The Association of Superannuation Funds of Australia (ASFA), January 202511

Citations

- https://www.smh.com.au/politics/federal/paul-keating-only-a-reckless-government-would-raid-super-for-housing-20170319-gv1a82.html; https://www.superreview.com.au/news/inaugural-super-summit-reaffirms-australias-envy-world-system

- https://smcaustralia.com/news/australians-super-savings-on-track-to-become-second-largest-globally-by-the-early-2030s/

- StatLink

- Australia soon to be second in world for retirement savings as superannuation pool soars - ABC News

- 211103_ASFA_Research_Note.indd

- https://www.abc.net.au/news/2025-04-02/australia-superannuation-retirement-savings/105098840

- Australian Super rushes in as peers take more cautious US stance – The Australian

- https://www.morningstar.com.au/personal-finance/7-eye-catching-charts-on-the-state-of-superannuation-today

- https://www.superannuation.asn.au/wp-content/uploads/2025/02/ASFA-research-paper-Super-and-the-economy.pdf

- https://foreigninvestment.gov.au/investing-in-australia/foreign-investment-framework

- https://www.superannuation.asn.au/wp-content/uploads/2025/02/2501-Super-statsv2.pdf