Pacific Energy

Pacific EnergyQIC’s sustainable distributed energy business Pacific Energy has successfully completed a new A$350 million debt facility, increasing its total debt facilities to A$1.2 billion to meet new and existing client demand for decarbonisation initiatives, and to support the company’s ambitious growth plans.

The expanded funding is a significant milestone and further step forward for Pacific Energy’s commitment to providing clean energy solutions and supporting Australia’s energy transition.

This debt facility follows Pacific Energy’s successful debt refinance in August 2022, which saw the overall facility limits increase from $500 million to $860 million.

For this latest financing, 50 per cent (A$175 million) has been allocated as a green loan tranche, specifically designed to finance renewable energy projects that meet Pacific Energy’s Green Finance Framework criteria. The facility also includes two new high-quality lenders to the syndicate, strengthening the overall lending group and bringing the total number of Pacific Energy’s lenders to nine.

Matthew Hall, Partner – Financing, QIC Infrastructure said Pacific Energy’s commitment to decarbonisation and sustainable energy solutions have been a driving force behind its success.

“We have worked closely with Pacific Energy on the establishment of this new debt facility. The new facility positions the business and management team well to continue to deliver on their transformational growth program which is underpinned by customer demand for renewable energy solutions,” Mr Hall said.

QIC acquired Pacific Energy in 2019 on behalf of its institutional investors. QIC’s global investments supporting the energy transition have now grown to A$9.5 billion. QIC‘s energy platform assets aim to invest more than A$15 billion in the energy transition over the next five years.

Pacific Energy is one of Australia’s leading producers of sustainable distributed energy, with a diversified portfolio comprising c. 900MW across 48 sites and five states and territories.

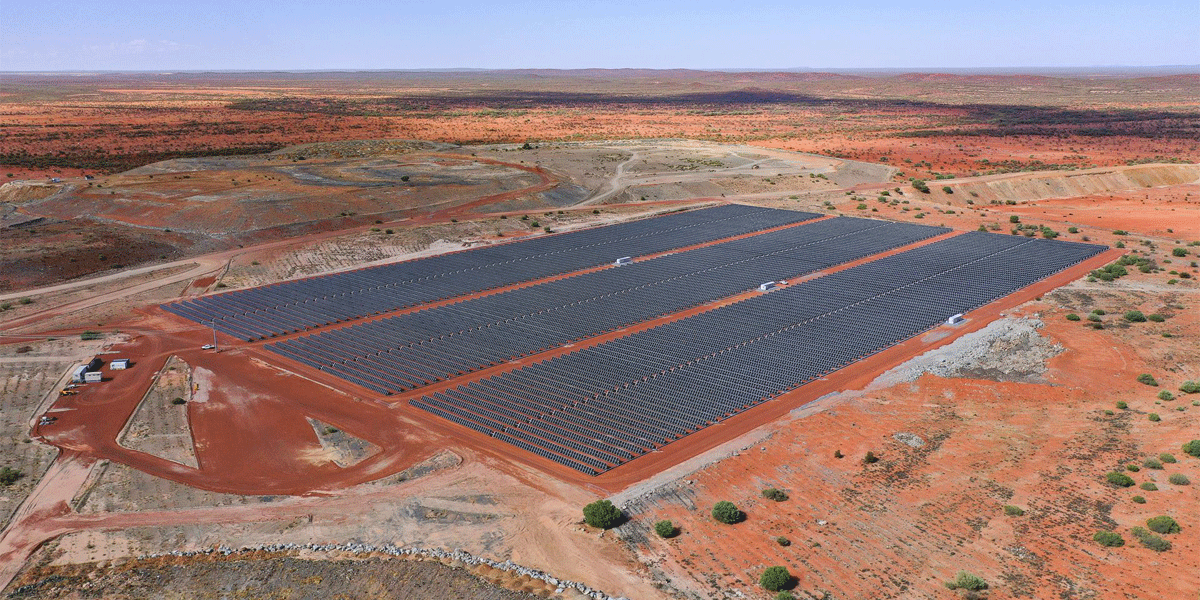

Recently, Pacific Energy also announced the successful design and delivery of four hybrid power systems for Westgold Resources Limited’s gold mining operations at its Tuckabianna, Bluebird, Fortnum and Big Bell facilities. These new hybrid systems replace six diesel power stations and are expected to collectively displace 38 million litres of diesel every year and reduce carbon emissions by up to 57.000 tonnes annually.

Tuckabianna power station and solar

Tuckabianna power station and solar Bluebird Solar

Bluebird SolarFor further information, please contact:

Further information

QIC is a long-term specialist manager in alternatives offering infrastructure, real estate, private capital, liquid strategies and multi-asset investments. It is one of the largest institutional investment managers in Australia, with A$106bn (US$72.5bn) in funds under management. QIC has over 900 employees and serves approximately 115 clients. Headquartered in Brisbane, Australia, QIC also has offices in Sydney, Melbourne, New York, San Francisco and London. (as at 31 December 2023)

QIC is a long-term infrastructure investor with an established international platform, an active management approach and a proven 17-year track record. With an international team of 87 professionals across five offices, QIC Infrastructure manages A$32.8bn (US$22.4bn) across 22 international direct investments and has realised in excess of A$15.2bn back to its clients. QIC has managed A$7.1bn in Australian energy assets since 2007 across the energy value chain (as at 31 December 2023).

Pacific Energy is an Australian market leader in the provision of sustainable distributed energy, operating for over four decades, with owned-and-operated assets at 48 sites nationally and c. 900MW of contracted capacity under management. www.pacificenergy.com.au

QIC Limited ACN 130 539 123 (“QIC”) is a wholesale funds manager, and its products and services are not directly available to, and this document may not be provided to any, retail clients. QIC is a company government owned corporation constituted under the Queensland Investment Corporation Act 1991 (QLD). QIC is also regulated by State Government legislation pertaining to government owned corporations in addition to the Corporations Act 2001 (Cth) (“Corporations Act”). QIC does not hold an Australian financial services (“AFS”) licence and certain provisions (including the financial product disclosure provisions) of the Corporations Act do not apply to QIC. Other wholly owned subsidiaries of QIC do hold AFS licences and are required to comply with relevant provisions of the Corporations Act. QIC also has wholly owned subsidiaries authorised, registered or licensed by the United Kingdom Financial Conduct Authority (“FCA”), the United States Securities and Exchange Commission (“SEC”) and the Korean Financial Services Commission. For more information about QIC, our approach, clients and regulatory framework, please refer to our website www.qic.com or contact us directly.

For more information about QIC, our approach, clients and regulatory framework, please refer to our website www.qic.com or contact us directly.

The statements and any opinions in this document (the “Information”) are of a general nature and for commentary purposes only and do not take into account any investor’s personal, financial or tax objectives, situation or needs. The Information is not intended to constitute and should not be relied on as personal legal or investment advice and it does not constitute, and should not be construed as, an offer to sell or solicitation of an offer to buy, securities or any other investment, investment management or advisory services.