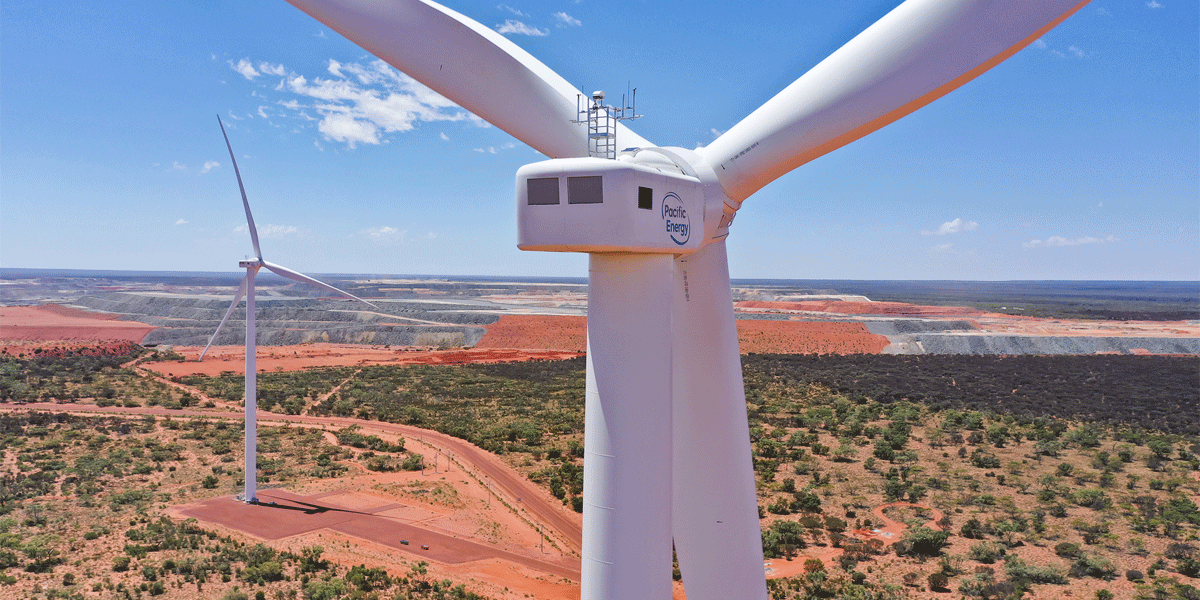

Image source: Pacific Energy

Image source: Pacific EnergyQIC has successfully completed a A$370 million equity raise and A$1.6 billion debt refinancing for Australia’s largest and market leading remote energy platform, Pacific Energy Group (PEG).

The new equity commitments from investors across Australia, Asia and North America, in addition to the new refinancing facility from a 15-bank lending group, provides Pacific Energy with over A$1 billion of financial capacity for its ongoing growth capex program.

With a contracted capacity of 946MW across 48 sites, the platform will continue to deliver on strong customer demand and a deep pipeline of development projects, including several recently executed Power Purchase Agreements.

QIC Head of Global Infrastructure Ross Israel said the fundraising momentum behind Pacific Energy represented a distinct opportunity to participate in Australia’s ongoing energy transition.

"Having invested in the energy transition thematic for over a decade, QIC has a deep understanding of the structural shifts reshaping Australia’s energy value chain, and we continue to see compelling and differentiated opportunities to deploy capital at scale,"

Ross Israel - QIC Head of Global Infrastructure

“That conviction has once again been endorsed by new and existing capital partners supporting us to grow Pacific Energy. In doing so, they have recognised the tailwinds driving customer demand for the company’s specialised and differentiated capabilities.”

QIC Senior Principal, Pacific Energy asset manager and board member Matthew Zwi said the platform has evolved significantly since QIC’s acquisition in 2019.

"In that time, Pacific Energy has invested heavily in its capabilities through a series of value-chain acquisitions, creating a highly specialised, vertically integrated remove energy platform with full in-house capability to design, construct, commission and operate hybrid renewable power projects." Mr Zwi said.

“The combination of these specialised capabilities and significant levels of prevailing demand for renewable and hybrid solutions in Australia’s remote energy sector have driven material growth in Pacific Energy’s portfolio.

“As the business has grown, it has also matured as an infrastructure investment through its increased portfolio scale and diversification and long tenor availability-based offtakes with inflation protection.

“With this growth capital raise completed and the business competitively refinanced, Pacific Energy is well positioned to capitalise on customer demand and deliver its growth pipeline, which includes a range of renewable and hybrid projects in Western Australia as well as on the East Coast.”

As part of a broader debt financing process, Pacific Energy received very strong demand from both existing and new lenders to form a 15-bank strong lending group.

This has allowed the business to fully refinance and upsize its existing bank facilities on extremely competitive pricing, terms and conditions. Across tenors of 5, 7 and 10-years, it has established a long-term, flexible financing structure commensurate with the business’ broader evolution.

Pacific Energy Group Chief Executive Officer Jamie Cullen said this improved pricing reflects strong market confidence in the platform’s business model and strength of the Pacific Energy portfolio.

"The successful upsizing of Pacific Energy’s debt facilities and equity raise mark a significant milestone in supporting our strategic growth ambitions, including our continuing east coast expansion,”

James Cullen - CEO, Pacific Energy Group

“This boost to our growth capital puts us in a strong position to advance our robust pipeline of renewable energy projects and take full advantage of the increasing opportunities in Australia’s transition to a low-carbon economy.

“We’re in a leading position to deliver long-term value for our customers, and at the same time, move the dial in a meaningful way towards a more sustainable future.”

As a leading off-grid energy provider, PEG is playing a key role in Australia’s natural resources sector and remote communities, displacing gas and diesel generation with build-own-operate renewable and hybrid energy solutions.

Pacific Energy most recently successfully completed a significant renewable energy expansion of its power system at the AngloGold Ashanti Tropicana gold mine in Western Australia.

The project added 61MW of renewable energy to Pacific Energy’s existing 54MW gas-fired power station bringing total capacity to 115MW, making it the largest off-grid hybrid system in Australia to power a mine.

The latest equity raise, with Campbell Lutyens acting as placement agent, takes the total amount of equity capital raised for Pacific Energy over the past 18 months to A$500 million.

Mr Israel said Australia remains a safe harbour for investors looking to diversify amidst ongoing global market uncertainty.

“What this oversubscribed funding round shows is there is strong demand from investors globally to continue supporting the energy transition, a clear trust in Australia as an investment destination and in QIC as a manager in the region and this sector,” he said

“Managing more than A$7.5 billion in Australasian energy transition assets, QIC has the established track record and an 86 strong experienced team to be a partner of choice in this generational investment thematic.”

QIC’s infrastructure platform is underpinned by an 18-year track record of sourcing, executing, and managing complex transactions across OECD markets and sectors.

Further information

QIC Infrastructure is a long-term infrastructure investor with an established international platform, an active management approach and a proven 18-year track record. With an international team of 86 professionals across five offices, QIC Infrastructure manages A$39.2bn (US$24.4bn) across 21 international direct investments and has realised in excess of A$19bn back to its clients (as at 31 March 2025).

Pacific Energy is an Australian market leader in the provision of sustainable distributed energy, operating for over four decades, with owned-and-operated assets at 48 sites nationally and 946MW of contracted capacity under management.

A trusted partner at the forefront of the clean energy transition, Pacific Energy is uniquely positioned to offer clients a complete in-house experience that delivers renewable and traditional power generation solutions from design, manufacturing and construction through to commissioning and operations and maintenance.

With unrivalled capability across all energy technologies, Pacific Energy has demonstrated experience integrating solar, wind, green hydrogen and battery energy storage into new and existing remote power systems, with an end goal to maximise efficiencies and minimise emissions.

Pacific Energy is headquartered in Perth, Western Australia and has operations in Kalgoorlie, Victoria, Queensland, the ACT, South Australia and the Northern Territory. It is owned by QIC-managed and advised funds. QIC is a globally diversified investment manager with more than A$125 billion in assets under management.

QIC Limited ACN 130 539 123 (“QIC”) is a wholesale funds manager, and its products and services are not directly available to, and this document may not be provided to any, retail clients. QIC is a company government owned corporation constituted under the Queensland Investment Corporation Act 1991 (QLD). QIC is also regulated by State Government legislation pertaining to government owned corporations in addition to the Corporations Act 2001 (Cth) (“Corporations Act”). QIC does not hold an Australian financial services (“AFS”) licence and certain provisions (including the financial product disclosure provisions) of the Corporations Act do not apply to QIC. Other wholly owned subsidiaries of QIC do hold AFS licences and are required to comply with relevant provisions of the Corporations Act. QIC also has wholly owned subsidiaries authorised, registered or licensed by the United Kingdom Financial Conduct Authority (“FCA”), the United States Securities and Exchange Commission (“SEC”) and the Korean Financial Services Commission. For more information about QIC, our approach, clients and regulatory framework, please refer to our website www.qic.com or contact us directly.

For more information about QIC, our approach, clients and regulatory framework, please refer to our website www.qic.com or contact us directly.

The statements and any opinions in this document (the “Information”) are of a general nature and for commentary purposes only and do not take into account any investor’s personal, financial or tax objectives, situation or needs. The Information is not intended to constitute and should not be relied on as personal legal or investment advice and it does not constitute, and should not be construed as, an offer to sell or solicitation of an offer to buy, securities or any other investment, investment management or advisory services.