One of Europe's largest independent bulk handling companies

QIC Private Debt Infrastructure has committed €50 million (~A$80 million) to a holding company junior loan financing for HES International BV (HES), one of Europe’s largest independent portfolios of dry and liquid bulk port facilities.

The QIC junior loan forms part of a €220 million six-year sustainability-linked junior loan financing to HES.

HES developed the framework for the Sustainability Linked Loan (SLL) in accordance with the SLL Principles, as set out by the Loan Market Association and Loan Syndications and Trading Association.

The junior loan forms part of a €1 billion debt capital raise by HES to further support the company’s growth and diversification strategy.

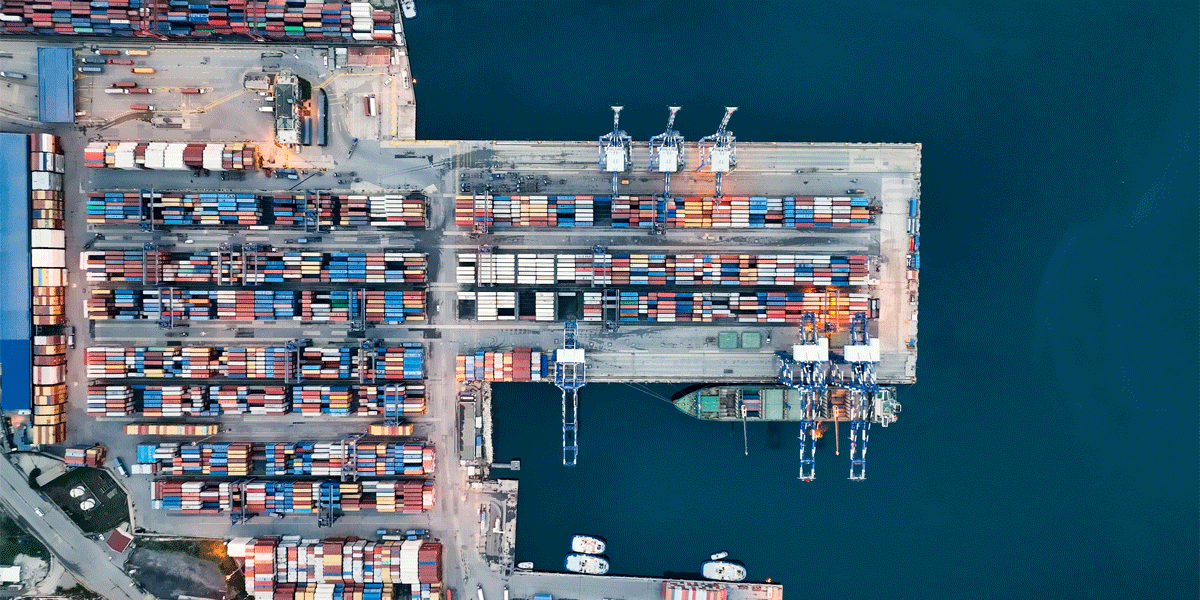

HES is one of Europe’s largest independent bulk terminal operators with a footprint of 15 terminals across five jurisdictions, including a key presence in European deep draft ports and the Amsterdam-Rotterdam-Antwerp region capturing trade flows in Europe’s industrial heartland.

The company provides dry and liquid bulk storage and handling services that form a mission-critical part of the supply chain for a diversified set of end markets across multiple dry and liquid commodities. The company is headquartered in Rotterdam and has been handling bulk raw materials since 1908.

Mr Nicholas Stockdale, Partner and Head of Europe, QIC Private Debt Infrastructure, said this transaction is the seventh private markets loan investment for QIC Private Debt Infrastructure.

“This deal further demonstrates our team’s ability to originate and execute attractive high yield infrastructure debt investments, which also embed ESG provisions,” Mr Stockdale said.

Mr Stockdale added, he believes there is a continued positive outlook for junior infrastructure private market debt for the medium-term, with several factors combining to allow investors to benefit in current market conditions – including the higher for longer interest rate environment.

“The relative value of junior infrastructure debt investments also continues to prove compelling,” Mr Stockdale added.

QIC Private Debt Infrastructure offers institutional investors exposure to diversified debt investments across the sectors of infrastructure (within the OECD), and corporate, asset-backed securities and real estate (in Australia and New Zealand).

For further information, please contact:

Further information

QIC Private Debt manages US$1.07bn (A$1.64bn) committed capital across Private Debt Infrastructure and Multi-Sector Private Debt offerings. Multi-Sector Private Debt provides diversified exposure to high-quality Australian and New Zealand private debt securities, including corporate direct and leveraged loans, asset-backed securities, and real estate debt. QIC Private Debt Infrastructure offers institutional investors exposure to diversified debt investments across the sectors of infrastructure (within the OECD), and corporate, asset-backed securities and real estate (in Australia and New Zealand) (as at 31 March 2024).

About QIC

QIC is a long-term specialist manager in alternatives offering infrastructure, real estate, private capital, private debt, natural capital, liquid strategies and multi-asset investments. It is one of the largest institutional investment managers in Australia, with A$111bn (US$72bn) in funds under management. QIC has over 900 employees and serves approximately 115 clients. Headquartered in Brisbane, Australia, QIC also has offices in Sydney, Singapore, Melbourne, New York, San Francisco and London. www.qic.com (as at 31 March 2024).

QIC Limited ACN 130 539 123 (“QIC”) is a wholesale funds manager, and its products and services are not directly available to, and this document may not be provided to any, retail clients. QIC is a company government owned corporation constituted under the Queensland Investment Corporation Act 1991 (QLD). QIC is also regulated by State Government legislation pertaining to government owned corporations in addition to the Corporations Act 2001 (Cth) (“Corporations Act”). QIC does not hold an Australian financial services (“AFS”) licence and certain provisions (including the financial product disclosure provisions) of the Corporations Act do not apply to QIC. Other wholly owned subsidiaries of QIC do hold AFS licences and are required to comply with relevant provisions of the Corporations Act. QIC also has wholly owned subsidiaries authorised, registered or licensed by the United Kingdom Financial Conduct Authority (“FCA”), the United States Securities and Exchange Commission (“SEC”) and the Korean Financial Services Commission. For more information about QIC, our approach, clients and regulatory framework, please refer to our website www.qic.com or contact us directly.

For more information about QIC, our approach, clients and regulatory framework, please refer to our website www.qic.com or contact us directly.

The statements and any opinions in this document (the “Information”) are of a general nature and for commentary purposes only and do not take into account any investor’s personal, financial or tax objectives, situation or needs. The Information is not intended to constitute and should not be relied on as personal legal or investment advice and it does not constitute, and should not be construed as, an offer to sell or solicitation of an offer to buy, securities or any other investment, investment management or advisory services.