Key Takeaways

- Junior infrastructure debt provides investors with access to regular, stable, and defensive income streams, generally uncorrelated with fluctuations in public equity markets, providing a reliable source of risk-adjusted returns.

- We are seeing significant premiums in junior infrastructure debt compared to senior infrastructure debt in this market.

- When compared to senior infrastructure debt, we view junior infrastructure debt as offering a compelling relative value proposition. It typically demonstrates a favourable risk/reward profile and an internal rate of return (IRR) approaching core infrastructure equity investments.

- Amidst a “higher for longer” interest rate environment, we anticipate a continued positive outlook for junior infrastructure debt in the medium term as performance is closely tied to inflation. Infrastructure debt typically utilises a floating interest rate strategy, allowing investors to benefit from current market conditions.

- Transaction activity is strong, particularly in the realm of refinancing for businesses with substantial capital expenditure, and to fulfill the infrastructure capital requirements that will support the energy transition.

What is private debt infrastructure?

Despite its compelling attributes, private debt infrastructure has sometimes been overlooked compared to some of its private debt and equity counterparts. However, as the world has emerged from a “lower for longer” economic environment, attention on this inflationary-linked asset class has rightly risen.

By their nature, infrastructure assets ranging from roads and airports to energy and digital facilities are valuable and defensive businesses, providing mission-critical services to society. These assets characteristically benefit from high EBITDA margins and are secured by robust cash flows, attributes which are frequently underpinned by long-term contracts, high barriers to entry, regulatory regimes or by virtue of being in a monopoly position. Through private debt instruments, institutional investors can access the advantages of infrastructure assets while benefitting from a debt position’s shorter tenor and favourable position in the capital stack.

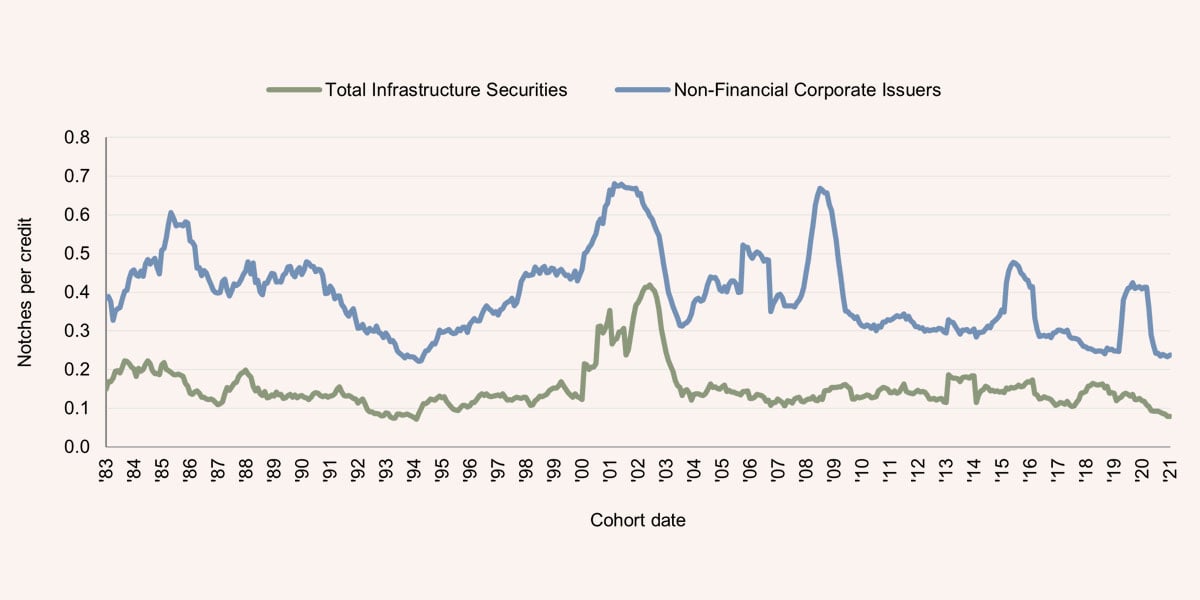

The lower rating volatility of infrastructure debt investments also proves compelling. Figure 1 compares the long-term rating volatility of asset securities, comparing infrastructure to non-financial corporates/non-infra businesses. Over this period, total infrastructure securities showed little volatility to major global market shocks, including the Global Financial Crisis (2008-09), the Euro Sovereign Default Crisis (2015-17) and COVID-19 (2020-22).

Figure 1: One year rating volatility, 1983 – 2021: total infrastructure securities and non-financial corporate issuers1

Figure 1: One year rating volatility, 1983 – 2021: total infrastructure securities and non-financial corporate issuers1 Infrastructure debt strategies can play a key role in portfolios, acting as a diversifier uncorrelated to public equity markets and a contributor to overall performance.

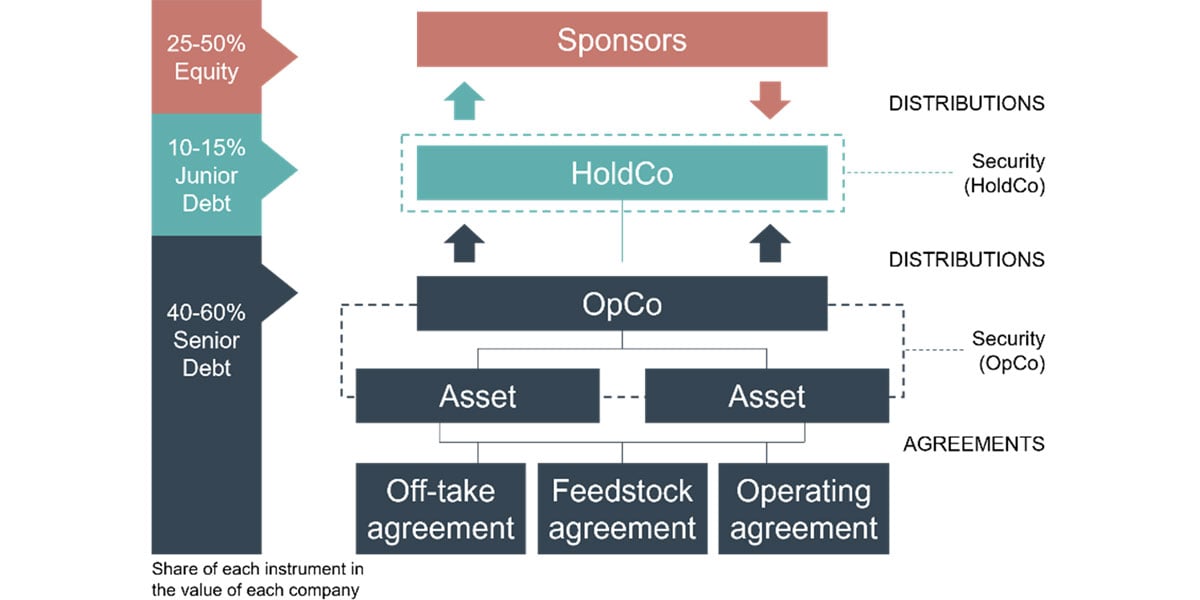

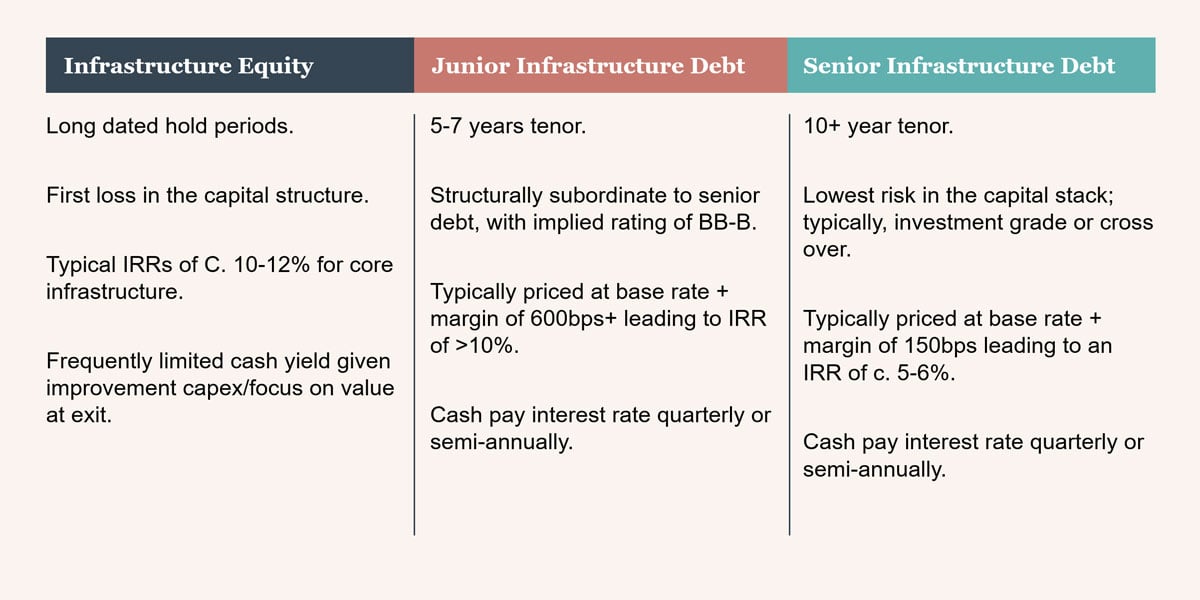

Infrastructure debt can take on various forms, as illustrated in the typical capital structure of an infrastructure asset below (Figure 2). Each type of debt (and equity) carries different levels of risk and return (Table 1).

Figure 2: Infrastructure Debt in a Capital Structure2

Figure 2: Infrastructure Debt in a Capital Structure2 Table 1: Comparing characteristics of the components of a typical capital structure

Table 1: Comparing characteristics of the components of a typical capital structure

At QIC, we see significant relative value in junior infrastructure debt.

The relative value of junior infrastructure private debt

Junior infrastructure debt typically benefits from the following characteristics:

- Relative value: junior infrastructure debt’s floating rate strategy may offer preferable relative value due to high market rates and attractive margins.

- Inflation protection: revenues are often linked to inflation, and with a floating rate strategy in place junior infrastructure debt is positively correlated.

- Strong credit quality: due to the robust cashflows, junior infrastructure debt has rating stability, lower defaults and high recovery rates compared to corporate debt.

- Attractive margins: junior infrastructure debt attracts less bank competition due to an unfavourable bank regulatory capital treatment, in turn potentially enhancing returns for institutional investors.

- Approaching equity IRRs: junior infrastructure debt has a preferred position in the capital structure and typically a minimum 30% equity cushion, providing an opportunity to enhance returns.

We are seeing significant premiums in junior infrastructure debt compared to senior infrastructure debt in this market. Senior debt is typically priced at 150-200 basis points above the floating rate because of its investment grade, whereas junior debt is currently experiencing a premium of typically around 300-400 basis points above senior debt.

Over the past 15 years, junior infrastructure debt credit spreads have demonstrated a strong risk-adjusted return profile3.

While senior debt is considered lower risk, junior debt retains similarly solid covenant packages, including extensive security, debt incurrence tests, cash sweeps, change of control protection and financial and information covenants. Additionally, the junior infrastructure debt market has fewer participants and a shorter-term tenor than senior debt, further contributing to its favourable premium.

A favourable outlook

Despite the turbulent economic waters the world has navigated over the last 24 months, we have seen credit spreads hold relatively stable at slightly wider levels across senior and junior debt.

The increase in base rates during this time, and to a lesser extent the credit spread, has resulted in private debt yielding greater returns than those seen by this asset class throughout the last decade. This is particularly true for junior infrastructure debt.

We see this as an important and timely opportunity for investors to consider the relative value of junior infrastructure debt given its performance in this macroenvironment and the considerable level of transaction activity occurring across refinancing, growth capex requirements and M&A activities.

For institutional investors interested in learning more about how QIC is managing investments in junior private debt infrastructure, contact our Client and Business Development Team.

Citations

- Source: Moody’s Infrastructure & Project Finance, 31 October 2022. No representation is made that any such statements or estimates will prove to be correct or that any scenario identified will actually occur. The information provided about the Private Debt Infrastructure asset class is generic in nature and relates to the class as a whole and is not specific to QIC offerings. Past performance is not a reliable indicator of future performance.

- Source: QIC

- Source: QIC, EDHEC and Barclays Bloomberg.

Further information

Private: The debt instruments are not traded on public markets and are often bilateral loans.

Tenor: 5-7 years is typical, though it can be longer.

Repayment: Bullet; partially amortization depending on debt sizing and asset type.

Security: First ranking security at HoldCo level (share pledge, bank accounts) providing significant collateral.

Floating rate: Market rate floor of zero, proving downside protection.

Margin: +600bps average.

Prepayment protection: Prepayment protection for 60% of loan life to legal maturity, ensuring minimum investment term.

Upfront fee: 2-3%

Rating: Not externally rated but implied ratings in BB-B area.

Mandatory prepayment: Senior re-leveraging; disposals; insurance proceeds.

Cash sweep: Typical to incentivise repayment prior to final maturity/reduce refinancing risk.

Financial covenants: Default and Lock Up across consolidated leverage ratios and consolidated cash flow ratios tested quarterly.

Information covenants: Audited accounts; quarterly accounts; compliance certificated; ESG.

Interest rate hedging: 75% of consolidated debt to limit downside risks.

Restrictions: Mergers, acquisitions, re-organisations, disposals.

Law: English or New York Law is typical.

Other: Cross default into senior; anti-layering provisions; change of control; debt incurrence limiting additional indebtedness.

QIC Limited ACN 130 539 123 (“QIC”) is a wholesale funds manager, and its products and services are not directly available to, and this document may not be provided to any, retail clients. QIC is a company government owned corporation constituted under the Queensland Investment Corporation Act 1991 (QLD). QIC is also regulated by State Government legislation pertaining to government owned corporations in addition to the Corporations Act 2001 (Cth) (“Corporations Act”). QIC does not hold an Australian financial services (“AFS”) licence and certain provisions (including the financial product disclosure provisions) of the Corporations Act do not apply to QIC. Other wholly owned subsidiaries of QIC do hold AFS licences and are required to comply with relevant provisions of the Corporations Act. QIC also has wholly owned subsidiaries authorised, registered or licensed by the United Kingdom Financial Conduct Authority (“FCA”), the United States Securities and Exchange Commission (“SEC”) and the Korean Financial Services Commission. For more information about QIC, our approach, clients and regulatory framework, please refer to our website www.qic.com or contact us directly.

For more information about QIC, our approach, clients and regulatory framework, please refer to our website www.qic.com or contact us directly.

The statements and any opinions in this document (the “Information”) are of a general nature and for commentary purposes only and do not take into account any investor’s personal, financial or tax objectives, situation or needs. The Information is not intended to constitute and should not be relied on as personal legal or investment advice and it does not constitute, and should not be construed as, an offer to sell or solicitation of an offer to buy, securities or any other investment, investment management or advisory services.